Deferred Income Double Entry

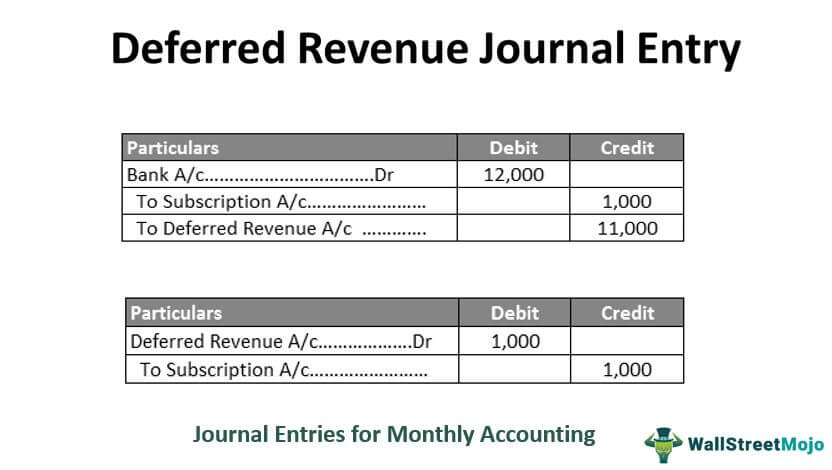

The journal entry for deferred tax asset is. For example if a member pays an annual membership renewal of 1200 in cash then the bookkeeping entry would as follows.

Accrued And Deferred Income All You Need To Know First Intuition Fi Hub

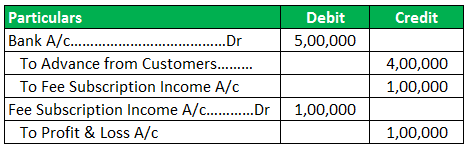

The double entry bookkeeping for membership dues paid in advance is similar to other forms of income.

. The income tax payable account has a balance of 1850 representing the current tax payable to the tax authorities. Past simple and past participle of defer 2. If the tax rate is 30 the Company will make a deferred tax asset journal entry Deferred Tax Asset Journal Entry The excess tax paid is known as deferred tax asset and its journal entry is created when there is a difference between taxable income and accounting income.

The effect of accounting for the deferred tax liability is to apply the matching principle to the financial. Past simple and past participle of defer 3. Current Tax Expense Dr.

The balance on the deferred tax liability account is 150 representing the future liability of the business to pay tax on the income for the period. The credit to the deferred membership income account represents a liability as the.

Adjusting Entries Double Entry Bookkeeping Accounting Notes Accrual Accounting Accounting Student

Deferred Revenue Journal Entry Step By Step Top 7 Examples

Comments

Post a Comment